What This Week’s Economic Data Really Means for Mortgage Rates

This week delivered the two most important economic reports of the month, and on the surface, both pointed toward friendlier conditions for interest rates. But if you have been watching rates closely, you probably noticed something unexpected. The market reaction was far more muted than most analysts anticipated.

Here are five key takeaways that explain what is really happening behind the scenes and what it means for buyers and homeowners as we head into the new year.

4

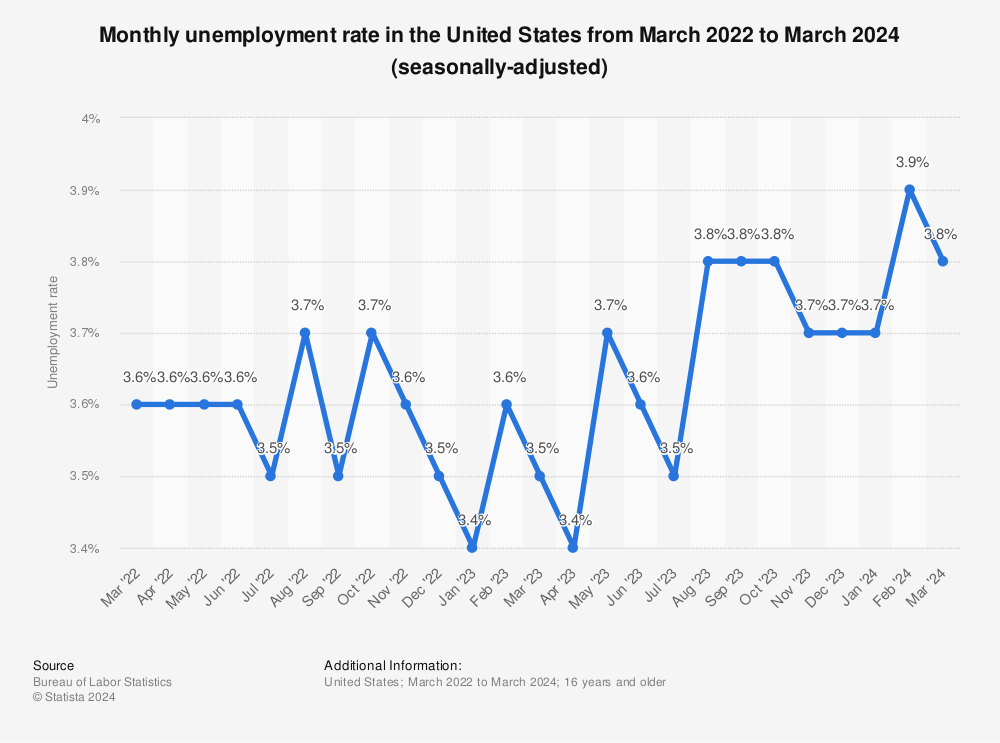

1. Unemployment Reached Its Highest Level Since 2021, but the Details Matter

November’s jobs report showed unemployment rising to 4.6 percent, above the 4.4 percent forecast and the highest level since 2021. Under normal conditions, this would have triggered a noticeable drop in mortgage rates.

Instead, the bond market barely moved. The reason is that the details beneath the headline told a more balanced story.

2. Rising Labor Participation Softened the Impact

The labor participation rate increased by 0.1 percent, meaning more people re-entered the workforce. When participation rises, unemployment can increase without signaling economic weakness.

This reduced the urgency for traders to push rates sharply lower.

3. The True Increase in Unemployment Was Modest

The unrounded unemployment rate rose from 4.440 percent to 4.564 percent. That change was just over one tenth of a percent.

Additionally, most of the increase came from temporary layoffs rather than permanent job losses. That distinction is important and helped limit downward pressure on rates.

4. Inflation Came in Lower Than Expected, but Confidence Was Limited

November’s Consumer Price Index came in well below forecasts, which is normally excellent news for mortgage rates. However, the data collection was affected by the government shutdown.

Because of those concerns, traders were hesitant to react aggressively. Rates did improve modestly, but much of that improvement was already in place before the CPI release.

5. Holiday Trading Is Keeping Markets Quiet

Late December is known for reduced market participation. With early bond market closures and holiday schedules, rate movement can be less predictable.

Most investors are waiting for fresh economic data in January before committing to stronger trends.

What This Means for Homebuyers and Homeowners

Mortgage rates are showing signs of stabilization and gradual improvement, but the most meaningful opportunities often come quickly when markets regain full participation.

If you are planning to buy a home, refinance, or tap into your home equity in the coming weeks, preparation matters more than timing guesses.

Take the Next Step While the Market Resets

Now is the ideal time to get pre-approved, explore your options, or speak directly with a mortgage professional before the next wave of economic data moves rates.

👉 Ready to Apply Now

Start your secure loan application here and take the first step toward your next home or refinance.

Apply Now:

https://prod.lendingpad.com/nexa/pos#/?loid=3dad20de-85fe-4343-887e-032ead4ca89e

👉 Have Questions or Want Personalized Guidance

Get clear answers and professional insight tailored to your goals.

Contact Us or Ask a Professional:

https://www.nolimithomeloans.com/ask-a-professional/